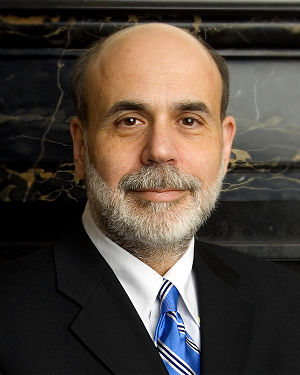

Image via WikipediaWhat is QE2 and what is the Federal Reserve trying to accomplish?

Image via WikipediaWhat is QE2 and what is the Federal Reserve trying to accomplish?The Fed decided to embark on a $600 billion plan to buy Treasury securities in order to balance out economic components to better fulfill their mandate for price stability and full employment.

Ben Bernanke’s statement:

“Measures of underlying inflation are currently at levels somewhat below those the [Federal Open Market] Committee judges most consistent, over the longer run, with its mandate to promote maximum employment and price stability. With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to remain subdued for some time before rising to levels the Committee considers consistent with its mandate …What happened with QE1?

“The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery and to return inflation, over time, to levels consistent with its mandate.” [1]

Mike Larson at FXStreet.com writes,

[In the housing and mortgage arena], [t]he Fed bought $175 billion in debt sold by Fannie Mae and Freddie Mac. It also bought $300 billion in U.S. Treasuries, and $1.25 TRILLION in mortgage backed securities — bonds made up of bundles of home loans. [2]Larson notes that key housing indicators such as housing starts, sales of existing homes, etc. demonstrate the failure of the QE1 effort to help the economy. [3]

Another writer sees the effort as likely to fail:

Mr. Bernanke is making the same blunder that we made with the past bubbles busts – if we can create paper profits and convince consumers that they should spend those paper profits then we’ll be on our way to economic prosperity. The problems arise when asset prices readjust lower to meet their true fundamentals. It’s ponzi finance and nothing more.Fed Independence in Danger? Or Fed Independence Is a Danger?

As I have previously explained, the goal of QE is to increase aggregate demand by creating a fictitious wealth effect and by increasing bank loans. [4]

The Federal Reserve’s massive involvement in the TARP bailouts and QE1 have led to criticism of the Fed for getting involved in fiscal (in addition to monetary) policy. Thus the Fed has been subjected to more than usual political criticism and calls for its abolishment, and a return to the gold standard.

When the Fed is arbitrarily inflating the money supply by trillions, there will eventually be much more inflation than they claim to want. Bernanke says QE2 is supposed to ramp up inflation a bit so as to balance out with increased employment, thus getting both the Fed’s mandates into line.

It is certain that the Fed has not succeeded in its full-employment mandate. There hasn’t been a great amount of inflation because much of the newly-created money has sat in banks’ Federal Reserve accounts drawing minimal interest because banks don’t see much demand for loans due to the Obama Administration’s promotion of threatening conditions, i.e. higher taxes, Obamacare, and general hostility toward business large and small.

Do We Know the Real Reason for This Project?

J. D. Foster at National Review Online thinks Bernanke is not forthcoming about his actual reasons for wanting this “stimulus,” because of possible political consequences, but apparently it is not wanted simply to stave off deflation:

… If the economy is expected to muddle through, let alone accelerate, then there is no reason to embark on a highly risky, highly controversial new round of quantitative easing [to prevent deflation].

Why won’t Bernanke be transparent in this? Because he also worries about the Fed’s independence. Imagine President Obama’s reaction if the chairman of the Federal Reserve were to point out the obvious truth that the economy dare not sustain a massive tax hike at this time. Or if he were to say that the prospect of such a tax hike is what forced the Fed’s hand on QE, despite the risks. Whatever Bernanke’s intentions, this would be interpreted as a blatantly partisan act by the non-partisan Fed. [5]Turn Off the Bubble Machine!

According to some of the Fed’s critics, especially of the Austrian school, the central bank’s manipulation of the currency is what brings on the bubbles, booms, busts, and accumulating inflation that our economy experiences. They point out that the Fed was slow to recognize (publicly, anyway) the housing bubble, leading to a deep recession which Peter Schiff was ridiculed for correctly predicting.

Marvin Hutchinson of Money Morning sees the Fed’s move as creating a commodities bubble that must burst:

By encouraging higher inflation - a stance that was clear in the recent statement of the policymaking Federal Open Market Committee (FOMC) - Bernanke is creating a commodities bubble that is already showing signs of distorting the global market. By keeping interest rates below inflation for years at a time, he is discouraging U.S. saving and encouraging leverage.

That leads to the creation of massive bubbles - such as are currently appearing in the junk bond market, and occurred in dot-com bubble of 1997-2000 and the housing bubble of 2003-06.

In the long run, the losses from those bubbles bursting - combined with the low savings rates - will destroy the U.S. capital base. Once the United States no longer has more available capital than its competitors, it will have less and less ability to create good-paying jobs and preserve U.S. living standards. Thus, unemployment will increase and real wages will decline. [6]A satirical article at The Onion was headlined, “Recession-Plagued Nation Demands New Bubble To Invest In.”

But we’ve had enough of the bubble-and-burst cycles.

World financial leaders oppose it.

Reuters reports:

Resentment abroad stems from worry that Fed pump-priming will hasten the U.S. dollar's slide and cause their currencies to shoot up in value, setting the stage for asset bubbles and making a future burst of inflation more likely.

“With all due respect, U.S. policy is clueless,” German Finance Minister Wolfgang Schaeuble told a conference.

“(The problem) is not a shortage of liquidity. It's not that the Americans haven't pumped enough liquidity into the market, and now to say let's pump more into the market is not going to solve their problems.” [7]Ambrose Evans-Pritchard at The Telegraph reports that the world views the Fed action as a move to devalue the dollar:

China's commerce ministry fired an irate broadside against Washington on Monday. "The continued and drastic US dollar depreciation recently has led countries including Japan, South Korea, and Thailand to intervene in the currency market, intensifying a 'currency war'. In the mid-term, the US dollar will continue to weaken and gaming between major currencies will escalate," it said. [8]Further, Evans-Pritchard writes,

As this anti-dollar revolt gathers momentum worldwide, the US risks losing its "exorbitant privilege" of currency hegemony – to use the term of Charles de Gaulle. [9]Evans-Pritchard expects the Fed’s policy to bring more food inflation to countries that can least afford it:

The innocent bystanders caught in the crossfire of Fed policy are poor countries such as India, where primary goods make up 60pc of the price index and food inflation is now running at 14pc. It is hard to gauge the impact of a falling dollar on commodities, but the pattern in mid-2008 was that it led to oil, metal, and grain price rises with multiple leverage. The core victims were the poorest food-importing countries in Africa and South Asia. Tell them that QE2 brings good news. [10]Conclusion

The Fed’s decision to implement QE2 will lead to inflation, reducing the value of the dollar, and aggravate currency relationships with other countries. This will contribute to weakened purchasing power for Americans, who already are cheated of the ability to gain from saving, and will contribute little to nothing to economic recovery. It will do nothing to increase demand in America or elsewhere.

Loosening money and credit even more won’t help when interest rates are near zero already, and banks are lacking customers who want to borrow. QE2 exacerbates the problem by introducing more risk and uncertainly into the markets. It’s been correctly characterized as a back-door tax increase.

Also, the Fed subjects itself to even more scrutiny and criticism, and risks the independence it so wants to protect. Both the dollar and the economy would benefit greatly from less manipulation and “help” from the government and the Fed.

[1] Mike Larson, “Fed confirms: QE2 on tap … despite dismal failure of QE1! Have these guys gone nuts??” 09/24/2010, FXStreet.com.

[2] and [3] Ibid.

[4] Pragmatic Capitalism, “Northern Trust: QE1 Failed, Why Will QE2 Work?” 10/10/2010.

[5] J.D. Foster, “Why Bernanke’s QE Justifications Don’t Wash,” 11/15/2010, The Corner, National Review Online.

[6] Marvin Hutchinson, “As QE2 Looms, Is the Fed Focusing on the Wrong Things?” 10/08/2010, Money Morning. (Emphasis added)

[7] Glenn Somerville and Zhou Xin, “Global anger swells at Fed Actions.” 11/05/2010, Reuters, via Yahoo! News.

[8] Ambrose Evans-Pritchard, “QE2 risks currency wars and the end of dollar hegemony,” 11/18/2010, The Telegraph (U.K.).

[9] and [10] Ibid.

Photo: Portrait of Federal Reserve Chairman Ben Bernanke. Public domain.

No comments:

Post a Comment